The following analysis will give an overview of the global in- dustrial coatings market. It provides insights the relevant seg- ments of industrial coatings – by analysing the segment spe- cific growth drivers and regional growth trends.

he industrial coatings market (i.e. OEM and Special purpose coat- ings) is stable and mature industry, characterized by high entry barriers (formulation know-how, strong distribution network and rela- tionships with large customers, high brand recall), asset light but dis- tributed manufacturing set-up and companies with global presence but with ability for local customisation.

This article aims to assess the growth across select sub-segments of coatings (not paints) in 2022, based on results announced by major coatings producers and analyse the underlying growth drivers for 2022. Identifying growth dynamics across select regions also aids in providing a perspective of the outlook for 2023.

AUTOMOTIVE OEM COATINGS

The global automotive OEM market is estimated to be

~EUR 8.35 billion [1]. It is a consolidated industry, with top 5 players (i.e., PPG, BASF, Axalta, Kansai and Nippon) accounting for more than

~75 %+ of global automotive OEM coatings market.

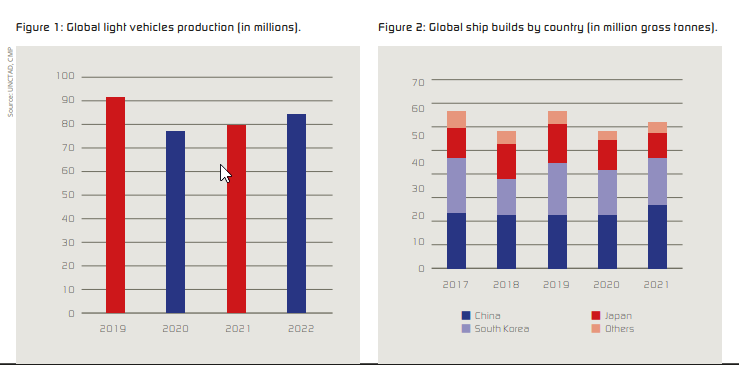

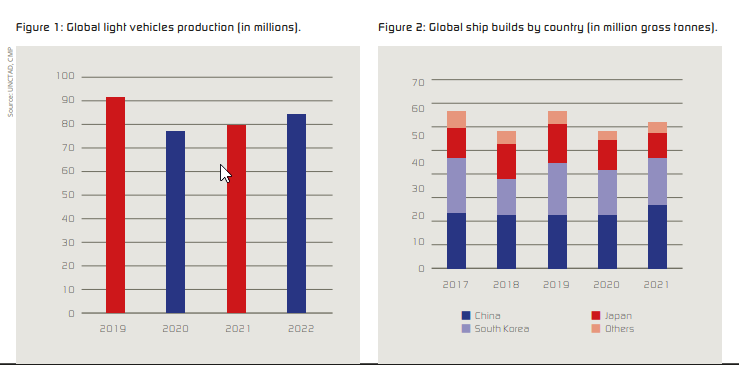

In 2022, the production of light vehicles (i.e., passenger cars and light commercial vehicles) grew by ~6-7 %, driven by strong growth in ASEAN and India and single digit growth in USA and China. The short- age of semiconductor chips continued, but things improved vis-à-vis

2021, leading to higher production. The automobile production, how- ever, slowed down in Europe (primarily Eastern Europe). The overall global production though remains below the pre-Covid-19 level.

Overall, the automotive OEM segment displayed strong growth in 2022, both in volume and revenues terms. Axalta and Nippon re- ported ~18 % and ~22 % growth respectively in their mobility coatings sales in 2022, driven by higher volume and price realisation. For PPG, the sales grew by more than 10 %, led by higher selling prices in all regions and higher sales volumes in US and Latin America.

In the first nine months of FY22 (i.e. Apr-Dec 22), Kansai reported

~26 % growth in sales of automotive coatings, compared to same period in FY21. There was impressive growth across all regions, with sales in India growing at stupendous 65 %, followed by North Amer- ica and Africa (both up 40 %). Asia and EU also reported increase in revenue (22 % and 25 % respectively) and lastly Japan (11 % up) Nippon reported revenue growth of 23.5 % in 2022 (vis-à-vis 2021), with Americas, China and Asia (ex-China) growing at 38 %, 31 %, and 29 % respectively. Japan was mostly flat. BASF’s sales within coatings segment – of which ~80% is from transportation segment - reported

~23 % growth in 2022, with ~5.1 % of this from volume and ~12.4 % from increase in selling price. The Americas region (including MEA) reported impressive growth of ~39 %, while Asia Pacific and the EU grew by 14 % and 12 % respectively.

Global auto production growth should be in positive territory in 2023. Vehicle production is improving gradually as the supply of chips im- proves (firms using alternatives, general-purpose products, etc.). Ac- cording to Standard & Poor, the global light vehicles sales is expect-

ed to grow at 3-4 % pa over next three years, driven by increasing replacement demand and easing of supply chain issues. Increasing adoption of electric vehicles (EV) would be another growth driver, as EVs are likely to have higher coating requirement (EUR186-279 per ve- hicle) as against traditional coating content of ~EUR 93 per vehicle [2].

MARINE COATINGS

Marine coatings market is estimated to be ~EUR 3.7 - 4.6 billion. This includes anti-fouling paints, applied to ship bottoms (i.e. the part that is submerged underwater) and anti-corrosion paints, which are applied to the entire hull (including tank interiors) to prevent iron corrosion. Anti-fouling coatings are considered as more value-added products. Within marine coatings, there are two customer segments:

New Ship builds: Customers are primarily shipyards. The growth is dependent on the number of new builds, with time lag of

~2-3 years between order receipt and completion of delivery. This market is concentrated, with China, South Korea and Japan accounting for ~94 % of shipbuilding in 2021. Coating prices vary depending on ship prices. This segment accounts for ~40 % of overall marine coatings.

Ship repairs: Customers are mainly ship-owners and shipping lines. Primarily anti-fouling paints are used and the pricing is relatively stable. Ship repairs/repaints is primarily a function of ship ageing and distance travelled (or volume of cargo transported).

Marine coatings market is highly consolidated, with top three produc- ers (i.e. Chugoku Marine Paints – CMP, Jotun and Akzo Nobel, account- ing for ~70 % of coatings market [3].

Following a period of uncertainty related to the pandemic over the past three years, the shipping industry made a strong recovery, driven by rising global trade volumes and high freight rates. As per Clarkson, fleet size increased by ~3.2 % to reach 2.2 billion deadweight tonnage (dwt) in 2022 and predicts it to further increase by 2.2 % in 2023 [4]. World fleet is now ~80 % larger than prevalent in 2008. Orderbook is increasing but remains at ~10 % of fleet. Global sea-borne trade in 2022 was ~12.2 billion metric tonnes, ~40 % higher than that in 2008. Clarkson predicts seaborne trade growth of 2.8 % in 2023.

The companies in this segment delivered impressive results. In 2022, CMP reported 17 % growth in sales of marine coatings in 2022, driv- en by 14 % growth in ship repairs segment and ~4 % growth in new ship builds. All the regions (except South Korea) reported double digit growth, with Japan, China and EU/USA increasing sales by 17 %, 12 % and 30 % respectively.

Similarly, Jotun reported sales growth of ~ 44 % for their marine coat- ings segment. In case of Jotun, sales in Europe, Asia, Americas and ‘Middle East, India and Africa’ grew by 30 %, 51 %, 44 % and 44 % re- spectively. Hempel reported sales growth of ~35 % for its marine coat- ings segment, reaching revenue of EUR 626 million, the highest ever revenues for this segment. According to Hempel, companies in this segment would continue to see good business momentum across all regions as dry docking increases and new ships get on the water. This momentum is expected to continue into 2023, as a number of new ship build projects are tendered over the next three years.

In case of new builds segment, the growth was on account of higher selling prices (in turn driven by increase in raw material prices) and growth in new ship builds. In ship repairs, the growth was primarily driven by increase in orders for ship repairs and the product mix e.g. Increase in demand of value added products such as premium high performance hull coatings, which help in reduction of fuel consump- tion and thereby improves energy efficiency. We expect the ship own- ers and ship managers to continue to invest in high-performance, pre- mium hull coatings to reduce emissions. Over longer term, the growth would also be driven by increasing fleet renewal due to decarbonisa- tion regulations and ageing fleet. E.g. one third of the existing fleet for crude oil (i.e. VLCC, Suezmax and Uncoated Aframax) are 15 year+ old while ~40 % of the fleet for 25-125 dwt products is 15 year+ old. Overall, we expect 2023 to be an another good year for this segment, supported by a strong pipeline for new shipbuilding and increase in dry-docking and protective opportunities that have been limited due to the Covid pandemic.

PROTECTIVE COATINGS

Protective coatings include coatings and finishes for protection of metal and structures, related to high value assets such as bridges and

Figure 3: Industrial coatings sales of Axalta and Akzo Nobel (in EUR million).

Table 1: Relative growth in different segments of industrial coatings.

stadiums, oil and petrochemical facilities and powder generation fa- cilities. Most of the times, this segment is typically clubbed with the marine coatings segment.

PPG’s sales of marine and protective coatings grew by mid-single digit

percentage primarily driven by selling price increases across all re- gions. For Akzo Nobel, the marine and protective coatings segment grew by 18 %, driven by volume growth in all regions (especially in Asia) and by better pricing.

On the other hand, Jotun’s protective coatings sales grew by 24 %, across all regions - with 55 % growth in Americas, 27% growth in APAC, Middle East and Africa, 24% growth in Scandinavia and Western Eu- rope, partly offset by 17 % drop in sales in Eastern Europe.

CMP industrial coatings segment (which is primarily protective coat- ings) registered sales decline of ~20 % in 2022. For CMP, China regis- tered the highest decline of ~77 %, while sales in Japan (their largest region) grew only by 1 %. Sales in US and EU registered growth of 21 %, South Korea grew by 22 % and South East Asia grew by 11 %. However, these regions could not compensate for sales decline in other regions.

METAL PACKAGING

Global market size of metal packaging coatings is about EUR 3.7 - 4.6 billion, It comprises of three major categories – beverage cans (in- cluding can ends), food packaging and aerosols. In terms of volume of cans, beverage cans and food cans / containers account for more

than ~95 % of can volume and the balance is accounted for by aerosol

coatings.

This is a consolidated market, with top three producers (i.e. Sherwin-Williams, PPG and Akzo Nobel) accounting for more than 70 % of the global market. Beverage can is the fastest growing cat- egory. It is estimated that ~392 billion beverage cans were shipped globally in 2022, which is about ~2 % higher than in 2021. Majority of the growth was driven by APAC and Europe. The beverage can mar- ket was subdued in North America. Consumer products companies increased prices for beverages and reduced promotional spend. This coupled with reduced consumer spending, limited demand growth. Sherwin-Williams’ metal packaging grew in the mid-teens in 2022, de- spite higher base (as the business grew in high 20s in 2021). The growth is driven by the shift from plastic to aluminium cans due to environmen- tal concerns, growing new product categories and a shift to non-BPA coatings. For PPG, the sales of metal packaging coating grew by high single digit percentage vis-à-vis sales in 2021, driven by better sales re- alization and higher volumes in US – with new business wins at several new beverage can customers and good demand for BPA free coatings. In 2023, the beverage can volumes are expected to grow at ~3-4 % glob- al with South America and EMEA growing in mid-to-high single digits.

GENERAL INDUSTRIAL AND POWDER COATINGS

General industrial coatings is a large fragmented industry, with vary- ing end markets: consumer appliances and electronics, agricultural and construction equipment (ACE), wood coatings, coil coatings, in- dustrial maintenance, architectural extrusions (windows, doors in residential as well as commercial buildings, metal furniture, electrical insulation (electrical boxes, wires) etc. Given the diversity of end uses, the demand in this segment is driven by a wide variety of macroeco- nomic factors, such as growth in GDP, new residential and commercial construction, as well as industrial production.

For Akzo Nobel, the powder coatings segment grew by 2 % respec- tively (in constant currency), driven primarily by higher selling price, despite lower volumes. From region perspective, Americas region ex- hibited double digit growth, with subdued performance in EMEA and APAC. For Akzo Nobel, the industrial coatings sales increased by 12 % (in constant currency), primarily driven by better price realisation, which offset lower volumes in coil, wood and architectural segment. Sales volumes dipped in the second half of the year due to softer market demand across regions. Sales in Americas and EMEA grew by double digit, with subdued sales growth in APAC.

Figure 4: Industrial coatings growth drivers (2022). Figure 5: Overall industrial coatings geography growth.

For PPG, the industrial coatings sales grew by high single digit in 2022, as strong selling price increases in all regions and solid volume growth in US and Latin America were partially offset by reduced sales vol- umes in China and Europe, reflecting lower economic activity in those regions. For Axalta, the industrial coatings sales grew by 4.8 % in 2022, due to higher average selling price (as a result of pricing actions taken to offset raw material and variable freight inflation) and lower sales volumes (on accounts of reduced industrial production in EU and China). For Jotun, the powder coatings sales grew by ~7 % - slowest amongst all its coatings segments – with higher sales in China, India and Turkey offset by slower growth in other regions and closure of its business in Russia.

In the powder coatings segment, rising production costs may impact volumes in select markets (especially Europe), while in others, high inflation may slow demand for consumer goods, such as furniture and appliances. With the slowdown in global economy and the industrial production, the outlook for this segment remains subdued in most re- gions. Reopening of China and continued growth in India may provide growth opportunities for coatings producers.

OVERALL INDUSTRIAL COATINGS MARKET GROWTH AND REGIONAL DYNAMICS

We estimate that the global coatings market in 2022 grew by ~6-7 % over 2021, primarily driven by higher selling price and/or improved product mix. The sales volume was largely flat, except in automotive coatings. Revenue variance analysis of top seven global coatings play- ers indicate that they were able to increase selling prices in range of

~10-20 % with median being 13 %. On the other hand, the volume growth ranged between -7 % to 5 % with median levels being -1 %. Forex fluctuations also impacted their sales in range of -5% to 6%, median levels being 3 %.

In terms of regional dynamics, Americas showed highest growth, due to better price realisation and higher volumes (e.g. automotive OEM). Demand was solid in most of the coatings segments. However, growth began to taper off in the last quarter of 2022.

Asian markets were subdued for majority of 2022, largely influenced by lower demand in China. The coatings market in India grew in dou- ble digits while other Asian markets were relatively stable.

Europe, Middle East and Africa (EMEA) markets declined in the last three quarters of 2022, with slowing economic growth and Russia- Ukraine conflict.

OUTLOOK FOR 2023

Industrial coatings demand is generally linked to industrial production and construction spending. According to the World Bank, the global economic growth is projected to decelerate sharply this year, to its third weakest pace in nearly three decades, overshadowed only by the 2009 and 2020 global recessions. This reflects synchronous policy tightening aimed at containing very high inflation, worsening financial conditions, and continued disruptions from the Russian Federation’s invasion of Ukraine. Standard and Poor global projects industrial pro- duction to drop from 3 % (in 2022) to ~1.4 % in 2023, with possibility of mild recessions in Europe and North America – economies that ac- count for half of global output.

Thus, coatings producers have entered 2023 in much sombre mood, as compared to the beginning of 2022. In China, demand for coatings products is expected to improve in 2023 supported by stronger do- mestic consumption and fewer mobility restrictions. China’s pent-up demand, along with continued demand growth in India should pro- vide support to the coatings industry.

REFERENCES

- PPG Investor Presentation

- PPG Investor Presentation

- CMP Investor Presentation

- Clarkson Investor Presentation

Disclaimer: The views expressed in the article above are those of the authors and do not necessarily represent or reflect the views of the organisation. Un- less otherwise noted, the author is writing in his/her personal capacity. They are not intended and should not be thought to represent official ideas, atti- tudes, or policies of the company. The comments of the author must always be used in the context that it has been spoken and should be factually and by the meaning of it, correct, especially in case of summarisation, translations etc.

Ashish Ladha

Aditya Birla Group

ashish.ladha@adityabirla.com